Guidelines for wage garnishment

These guidelines only apply for leave payments made by BUAK directly to the employee. Companies that have set up an escrow account into which BUAK transfers the leave payments are not affected by these rules.

In accordance with § 299a (3) EO, the Construction Workers Annual Leave and Severance Pay Fund [Bauarbeiter-Urlaubs- und Abfertigungskasse] (BUAK) can make the payments against the debt itself in cases of wage garnishment, according to the employer’s information and calculations. This provision is implemented in accordance with these guidelines.

Disclosure of additional information when submitting leave

1. In cases where the employment income of a worker subject to BUAG has been subjected to wage garnishment as per § 290a ff EO, the company (the business subject to BUAG) must disclose the following information to BUAK for each leave submission, in addition to all other information requirements:

-

Notification that seizure as per § 290a ff has been initiated against the worker;

-

Type of seizure (normal garnishment, seizure of support payments as per § 291 b EO)

-

Outstanding (remaining) amount owed

-

Support obligations (total; the employee is not included in the calculation)

-

The court authorising the seizure, as well as the business number (E-Zahl) of that court. In the case of direct seizure by authorities, the name of the authority and its business number

-

Information on creditors or their legal representatives (name(s) of the person(s) who are entitled to receive the seized amounts)

-

File number of the creditors or their legal representative

-

Bank account information of the creditor or their legal representative

-

Whether the employment contract started in the month when leave began, or whether the employment contract ends in the month when leave began, and the start/end date as appropriate

- Other important information (e.g. whether an instalment plan is in place, or whether a legal aggregation has been ordered as per § 292 EO)

The form for disclosure of wage garnishment information is provided below.

Consideration of non-garnishable exempt amounts

2. The monthly non-garnishable exempt amounts as per § 291 a EO are taken into consideration as follows:

-

For current income (holiday/leave pay), the information provided by the employer is used to convert the amount into a number of days, using social security days as the basis for pro-rating.

-

In practice, leave compensation for a calendar year – also including the portion that is a holiday allowance and therefore a special payment – is paid out as partial payments, potentially spread out over several calendar months. Like current income (holiday/leave pay), the non-garnishable exempt amount that applies to the special payment is converted into a number of days.

Weitere Richtlinien

3. When settling the submitted leave, the exempt amounts from current income (holiday/leave pay) and special payment (holiday allowance) which are associated with the submitted leave days are paid out to the employee. The garnishable portion is brought directly to the creditor or their legal representative for payment.

4. The part of the exempt amount as per § 291 a EO that BUAK pays out to the employee is listed separately in the leave statement provided to the company and the employee.

5. The amounts sent to the creditor or their legal representative for payment are also listed separately in the leave statement provided to the company and the employee.

6. The payments made by BUAK to the creditors or their legal representatives are fully credited against the debt both for the company (the business subject to BUAG) and for the employee.

7. The company (the business subject to BUAG) must take account of the payments made by BUAK and listed in the statements as per points 4 and 5 of these guidelines, both in the wage statement and in the calculation of garnished amounts and amounts payable to the employee’s creditors.

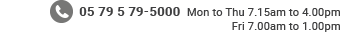

If you have questions or need more information, please contact ue@buak.at. Feel free to contact us by telephone at 0579 579 ext. 2115/2119.

Please send us wage garnishment information using the form if necessary.